The New Handshake: Where We Are Now

-

1 Making It Tough for Consumers to Get Solutions

How long were you on hold last time you tried to call customer service regarding a complaint? Hold times are getting longer, sometimes as long as an hour. Indeed, reaching a live representative is increasingly difficult. It is therefore no surprise that consumers lament the lack of meaningful access to customer assistance with respect to their purchases.

Companies also may restrict remedies knowing that most consumers are unlikely to read their contracts, let alone understand what the contracts really say. Studies have shown that most consumers ignore contract terms when signing up for a site or service, even when the website requires concrete action such as clicking a link on a website or scrolling through the terms all the way to the end. Contract terms in e-contracts also may be confusing. They are filled with legalese, and often obscured by online ‘pop-ups’ and other shrouding techniques. It would take enormous patience and intelligence to read and understand the terms in many common contracts.

At the same time, consumers often assume that they will not really be required to abide by the terms of their contracts. For example, they may figure that companies will be honourable and provide remedies if anything goes wrong, regardless of ‘fine print’ exclusions in the warranty. Consumers also may suffer from over-optimism, cognitive dissonance and confirmation bias with respect to their purchases. At the time of purchase, most consumers optimistically presume there won’t be a problem, so they don’t worry about terms or eventual remedies when they click the accept box to complete a purchase. Likewise, they want to believe that they made wise purchases, to avoid any dissonance. This also means that when problems do arise, consumers often ignore the problem in hopes of confirming their wisdom.

Most consumers also suffer from inertia when they sign up for new websites, which prevents them from proactively reading or seeking to change contract terms before they agree. That inertia also hinders consumers from pursuing a claim if it would require them to hire an attorney, or to file a claim in court or with an arbitration association. It’s true: we are all pretty lazy. Furthermore, many of the face-to-face resolution procedures specified in online terms and conditions require sophistication and resources that many consumers do not possess. Most consumers do not have the time, money, or education to deal with legal processes.

Merchants also know that consumers very rarely take complaints to the courts, federal regulators, or third parties such as a local chamber of commerce or the Better Business Bureau (‘BBB’). Anger may fuel a consumer’s initial e-mail or phone call regarding a purchase problem, but consumers generally do not follow up after receiving no reply or when facing long hold times with customer service phone lines. Customer service representatives may also lack authority to provide remedies, or may make it very stressful for consumers to obtain any redress. All merchants have to do is provide a little procedural complexity and the vast majority of consumers drop the issue. -

2 The Squeaky Wheel System

So who does get redress in the current system? Only those consumers who are sufficiently motivated to make a lot of noise, or to pursue redress options that other consumers would dismiss as too time consuming and frustrating. This creates the ‘squeaky wheel system’ (SWS) in B2C exchanges. This SWS concept encompasses the notion that the ‘squeaky wheels’ – those consumers who are proactive in pursuing their needs and complaints – are most likely to get the assistance, remedies and other benefits they seek. Meanwhile, those who remain silent because they lack the knowledge, experience or resources to artfully and actively pursue their interests usually do not receive the same benefits.

Merchants appease the squeaky wheels in order to prevent negative publicity and avoid giving remedies to the majority. They also may point to the resolutions provided to this small number of squeaky wheels as evidence that problems are being resolved. Resolutions are rationed to the customers who make the most noise, while consumers with the least time and resources to learn about, understand or pursue their claims are left without remedies. Merchants use this SWS to waylay lawsuits and other public complaints, and to keep the majority of consumers unaware of their potential rights. This also allows merchants to save remedy costs and keep claims out of the public eye.

Defenders of the theory that the current market structure promotes efficiency and fairness argue that regardless of whether most consumers bargain for efficient contract terms or improved company practices, this informed minority will speak for the uninformed masses. This minority will then pressure companies to improve their contracts and practices or face the risk of lawsuits and negative publicity. Studies, however, cast doubt on the existence of this ‘informed minority’ – let alone informed (or any) consumers’ propensity to champion the masses.

Complaint systems therefore become skewed in favour of the most experienced, educated and powerful consumers who know how to artfully submit complaints and get what they want. These consumers then have little to no incentive to alert the majority about available remedies, and they become essentially complicit in the exploitation of the uninformed majority by reaping the benefits of remedy rationing. Companies dedicate resources to assist these powerful consumers while keeping the majority in the dark about their rights and remedies. At the same time, the interests of this informed minority may not overlap with the interests, needs or types of claims experienced by the majority.

Merchants may then manipulate the market by appeasing, and thus quieting, the few sophisticated squeaky wheels who pursue contract changes and remedies when problems arise. Consumers with higher incomes and more education thus end up on top in a consumer caste system. The squeaky wheels expect more and get more from their purchases than those in lower socioeconomic status groups. One study indicated that “for every 1,000 purchases, households in the highest status category voice complaints concerning 98.9 purchases, while households in the lowest status category voice complaints concerning 60.7 purchases.” -

3 Social Pressures Not to Pursue Redress

Societal influences and stereotypes also play into the SWS and hinder consumers from asserting complaints or getting remedies in person. As an initial matter, culture teaches individuals not to ‘rock the boat’ or complain. This is especially true for women, who may be especially reluctant to assert complaints or pursue their needs due to fear of appearing ‘pushy’. Women also are much less likely than men to recognize opportunities to negotiate and usually use less assertive language than men when they do pursue negotiations. Similarly, research shows that black consumers are less likely than white consumers to realize opportunities to complain regarding their purchases. In addition, these consumers often do not receive the same purchase benefits as white consumers regardless of education or income.

Conscious or subconscious biases may lead business representatives to offer the least advantageous prices to racial minorities. This coincides with research indicating that consumers in lower socioeconomic status groups often become accustomed to poor treatment and have lower expectations regarding the quality of their purchases and their ability to obtain remedies if problems arise. Consumers with a lower socioeconomic status also are likely to have less confidence, fewer resources, lower levels of education and are possibly hindered in asserting themselves due to limited English proficiency. Of course, ‘status’ is an ill-defined term and no assumptions or studies apply for all consumers. Nonetheless, data suggest a growing divide between the high-power ‘haves’ and low-power ‘have-nots’ based on income, education and age.

Furthermore, stereotypes and biases may augment this divide, especially when individuals interact face-to-face and consciously or subconsciously make assumptions about the other based on race, gender and age. Customer service associates’ conscious and subconscious biases may affect how they treat consumers, and lead them to offer less advantageous deals to racial and ethnic minorities and women. Consumers also may make assumptions about customer service associates, which may impact their interactions and impede their access to remedies. Furthermore, consumers may perpetuate their own low-power status by assuming that they will be unfairly judged or brushed aside. For example, a woman fearful that she will appear ‘pushy’ if she seeks assistance may feel constrained in her communications with customer service representatives. These forces all contribute towards consumers receiving different deals and remedies. -

4 A Broken System for Consumer Redress

In sum: The SWS, along with behavioural and sociological propensities, leave the vast majority of consumers without remedies, while merchants cash in by saving on remedy costs and keeping claims off the public radar of courts and government regulators. This also hinders consumers’ access to information that would assist them in ‘voting with their feet’ by choosing to avoid or leave companies that have bad track records with respect to the goods and services they provide. The SWS also means that the individuals who already enjoy disproportionate power due to social or economic status usually receive disproportionate benefits.

Of course, there are legitimate arguments against these critiques. For example, some law and economics theorists posit that strict contract enforcement results in an optimal allocation of resources overall, even if a few consumers lose out on their claims. They suggest that consumers buy the optimal quality and quantity of goods and services under competitive terms, and this competition drives companies to cater their deals to serve consumer preferences. These theorists also surmise that merchants will strive to provide remedies and appease customers as part of this competitive process.

In reality, however, most consumers do not have perfect information about the market and do not read or understand their rights, let alone the complicated terms commonly appearing in form contracts. Consumers therefore fail to purchase optimal quantities or bargain for competitive and efficient terms. Moreover, they often fail to realize their rights or the remedies that they deserve. This arguably leaves market players free to take advantage of consumers’ lack of information and bargaining power. It is therefore unlikely that the market is policing the fairness or efficiency of consumer contracts.

For example, researchers who studied consumers’ internet browsing behaviour on 66 online software companies’ websites found that only one or two out of 1,000 shoppers actually accessed the companies’ standard form contracts (referred to as end-user software license agreements, or ‘EULAs’). Furthermore, they found that shoppers rarely read product reviews or otherwise seek information about the terms and conditions of their purchases.

Similarly, it is unlikely that a sufficient number of proactive consumers will regulate merchant practices by spreading information and taking action regarding purchase problems. One European study found that only 7% of consumer cases ended with a resolution in court or an alternative proceeding. The researchers also found that 45% of launched complaints ended with no agreement or decision, suggesting that consumers who took initial action on their complaints gave up their pursuit along the way. While some complaints may truly lack merit, the study’s findings suggest that perhaps even initially proactive consumers are unlikely to continue a fight to the benefit of themselves, let alone all consumers.

Furthermore, it is becoming more difficult for consumers to even become informed about their rights and remedies due to the high costs of obtaining information and pursing contract claims. For example, only 16% of the nearly two-thirds of Consumer Reports survey respondents who claimed that they actually read all of the disclosures regarding a new loan or credit card said that they found the disclosures easy to understand. In addition, well-meaning policy makers have advanced disclosure laws aimed to address information asymmetries that often leave consumers in the dark about their rights. However, these seemingly pro-consumer rules often backfire by adding to the information overload that already clouds consumers’ comprehension of their contract. These disclosure rules also may increase consumer costs to account for the expense of compliance. Consumers are simply overwhelmed by lengthy contracts.

Companies also may discourage consumers’ attempts to read purchase terms by using especially complicated fine print in their contracts and teaser promotions. For example, lenders may stealthily add credit insurance provisions into loan documents using confusing language that most consumers do not understand. It is nearly impossible for even so-called sophisticated consumers to understand such credit provisions.

Big data has added to this challenge. Data brokers gather a vast amount of information about consumers and use it to determine how each buyer will be treated in the marketplace. Such data collection is often benign when consumers initially give their consent, and it is aimed at helping companies to funnel their marketing dollars towards attracting consumers who likely seek their goods or services. However, the data collected can also be used to disadvantage buyers. Collected data may lead to differential pricing or exemptions from cash back or layaway purchase options. In this way, big data can increase the information asymmetry between merchants and consumers.

Most consumers feel powerless when seeking remedies regarding their purchases. For example, the majority of cellular phone customers feel they must submit to price increases and added charges. This is especially true when the consumer does not have time or resources to research her options and is striving to retain cellular services in a market dominated by relatively few companies. Consumers have become acutely aware that oligarchic market conditions such as those in the cellular service industry give the companies great power in determining prices and contract terms. Merchants may therefore capitalize on consumers’ lack of resources and power, knowing that relatively few will seek contract changes. -

5 Class Actions

The most common kind of consumer mass claim in the US is the class action. When a group of consumers all experience the same problem in interacting with a business, those buyers join a class, which is represented by lead plaintiffs and one lawyer or group of lawyers. Once the class is certified by a judge, the lawyer representing the class can approach the business and explain the nature of the class action and outline an appropriate remedy. The individual claimants generally have no initial costs. Instead, the lawyers who convene the class cover the costs to pursue the case, but later take a prescribed percentage of the eventual settlement or award. This can benefit consumers when they do not have to attend hearings, pay any costs or invest any time or money in the proceedings. However, these processes often go on for years, and may not result in perfect or complete redress.

Businesses often face a difficult choice when presented with a class action. They can bear the costs and negative publicity of fighting the class action in court or quickly settle to end the action. Businesses fear class actions because they usually take years to defend, and cost businesses a great deal in legal fees with no guarantee of a beneficial outcome. Some of the class actions that have gone to trial have generated surprisingly costly decisions against the businesses in question. Moreover, the negative publicity alone can close a vulnerable business. Accordingly, businesses usually settle class actions based on simple cost calculations. Maybe legal costs are projected to exceed the value of the payout, or maybe the bad press generated by the class action will be too onerous for the business to bear.

Class actions are intended to hold businesses accountable for their behaviour, and they create financial incentives for businesses to do the right thing by their customers or face serious financial consequences. For very serious issues (e.g. drugs that caused serious injuries or death or communities who suffered from pollution of the water supply caused by secretly dumping chemicals), class actions may be the best way to get justice. Big payouts may go a long way towards providing justice to individuals and families victimized in these ways, and businesses may be more careful in their future dealings if they know the risk of a class action exists.

For an online consumer, however, the experience of participating in a class action is decidedly mixed. On the one hand, many consumers are opted into a class without being aware that there was ever a problem in the first place. If all goes right, the consumer can fill out some paperwork, wait for the process to play out, and get a check they may or may not even deserve.

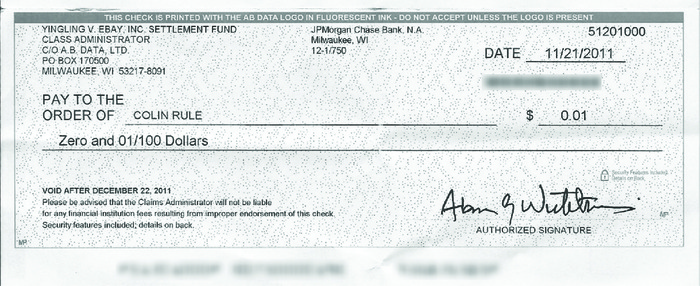

In the usual scenario, however, the class action process can take years to resolve and consumers are often left with little redress while lawyers reap high legal fees. Many consumers have the experience of being opted into a class and waiting several years to get a tiny reimbursement. As you can see in Figure 1, Colin received a 1 cent reimbursement check from a class action that was filed against eBay (Colin’s former employer). The issue targeted by the class action was a seemingly trivial matter, a slightly higher charge for items within a certain category of the eBay marketplace. Colin did not opt into this class; he was opted in by the lawyers who filed the case, and who did not require Colin to fill out any paperwork. The class action administrators paid 44 cents for a stamp to mail Colin this 1 cent check. Why would anyone bother to file a class action for a 1 cent reimbursement? They wouldn’t. But the lawyers who filed the case ended up making tens of millions of dollars when eBay decided to settle. There were many millions of eBay customers in the class these lawyers had certified, and while each individual eBay user didn’t make much money, the percentage awarded to the law firms who pushed the class action was quite substantial.The one cent class action settlement check

Amy had a similar experience, where she was opted into a class action against a cell phone provider and received no real payout. Instead, she merely received a coupon that would have required her to continue buying from that provider – while the lawyers gathered legal fees and announced victory. Now there are even some class actions where the consumers get nothing, but the lawyers still get their payout. A recent privacy class action was settled with Yahoo where the consumers in the class who had their privacy violated got no reimbursement, but the lawyers who filed the case made millions of dollars. Many of the readers of this article likely have similar stories.

As in any type of court case, there are both justified class actions and unjustified class actions. There are definitely examples of abuse, but there are also many examples of justice being done. The question is, do class actions provide a resolution experience that best protects online consumers? We would argue the answer to that question is no. Buyers want fast and fair resolutions, preferably in minutes or days, not weeks or months or years. The bulk of the benefits in these e-commerce class actions go to the lawyers, not the consumers who are ostensibly the wronged parties. There are so many costs and procedural requirements in the class action system that the lawyers usually end up getting paid a good bit of the money that should be going to the consumers directly. The class action process is too slow and too inefficient to provide consumers the kind of redress they say they want. -

6 The Growth of Binding Arbitration Clauses for Consumers

At the same time, class actions have been essentially shut down in many consumer contexts in the wake of the arbitration revolution in the US over the past 20 years. Over that time, the Supreme Court has become increasingly pro-business in enforcing pre-dispute arbitration clauses in B2C contracts. This really came to a head in 2013 with the Supreme Court’s decision in AT&T v. Concepcion. That case significantly increased businesses’ power to block class actions by enabling businesses to include a pre-dispute arbitration clause with a class action waiver in their consumer contracts. State courts had been using state contract defences to limit enforcement of these clauses, but the Court in AT&T held that the Federal Arbitration Act (FAA) pre-empted the California court from applying a general contract defence to preclude enforcement of the arbitration clause in AT&T’s contract with its consumers.

After that decision, there was an immediate wave of General Counsels integrating Concepcion-style arbitration clauses into their companies’ terms and conditions. If you check the terms for your bank account, credit card, cell phone or favorite website, you’re likely to find plenty of examples. Many companies were delighted to finally have a way to protect themselves from class action exposure through the use of these clauses. The clauses often direct consumers to submit their claims to F2F procedures that require an immediate deposit of filing and administrative fees. This deposit hinders consumers’ incentive to file a claim, especially when the initial filing and administration costs outweigh any potential recovery through the procedure. This is true even if consumers may be able to recoup fees if an award is made in their favour. Moreover, these clauses nearly always preclude class proceedings of any kind. It does not take much examination to conclude that the primary focus of these clauses is to block consumers from joining any kind of class or combined proceeding.

The Consumer Financial Protection Bureau (CFPB), the Federal consumer advocacy organization championed by Elizabeth Warren and now run by Richard Cordray, was given authority by the Dodd Frank Act to investigate the use of these arbitration clauses and issue regulations with respect to consumer financial products and services. Their recently released draft regulation on the subject indicates that they will move to ban the use of these pre-dispute arbitration clauses where they would preclude consumers from joining a class action. Based on the statistics shared by the CFPB, it is clear from the case filing data that most consumers simply aren’t using these face-to-face arbitration options to get redress. Hundreds of thousands, and even millions, of consumers obtain some level of redress, however small, from class actions each year. In contrast, very few consumers exercise their right to arbitration each year. That volume differential provides a stark reason to be concerned about how these arbitration clauses and class action waivers may be denying consumers effective redress.

Again, it generally makes no economic sense for a consumer to pay hundreds or thousands of dollars in filing fees and travel costs to assert an individual claim regarding a modest amount of money. Take the example of a defective cellular phone that costs $300. It may be worthwhile for a consumer to join a class action with many other consumers who have faced similar problems with their phones. This is true even if the consumer only gets $150 in the final settlement after paying their attorneys. However, that same consumer would not have that option if there is a pre-dispute arbitration clause in their contract. The consumer would have to act on her own, and pay arbitration filing and administrative fees, in the hopes of recouping the fees in an eventual award. Most consumers quickly conclude that it is simply not worthwhile to pursue redress through arbitration − especially taking into account the time and hassles of a F2F proceeding.

It is important to note that the new CFPB regulations will not help that cellular phone customer. Cellular phone contracts are not financial products or services, and the CFPB only has the authority to regulate financial institutions. Furthermore, the CFPB regulations was not finalized at the time of this publication. Politics and regulatory mechanisms are likely to generate delays that will leave the regulations in limbo. Nonetheless, the data already released by the CFPB makes clear that consumers are extremely unlikely to pursue their rights through the existing F2F arbitration processes. And for many consumers in a post-Concepcion world, those processes are their only available option.

Mandatory arbitration provisions also privatize dispute resolution, which enable companies to unilaterally design their own legal rules. This enables companies to design redress processes that are quite different from what the courts provide. For example, most private resolution processes keep the outcomes achieved by consumers private. This may limit public access to information regarding faulty products and company improprieties. Without this public knowledge of these filings and their outcome, it can be difficult to uncover products that should be recalled and inform the masses about companies’ malfeasance. For example, Consumer Reports found in a 2010 survey that less than a quarter of the respondents said they researched product recalls, and only a fifth of the respondents were aware of recalls regarding products they had purchased in the past 3 years. Furthermore, “an additional 15 percent simply threw the product in the trash rather than returning it for a refund, an exchange, or a free repair.” Keeping resolutions confidential stymies regulation of defective products, which may place consumers at increased risk of harm. Furthermore, it again suggests a need for expanded and readily accessible remedy systems that lower the hurdles to obtaining remedies and raise expectations regarding customer care. -

7 Limitations on Legal Redress Options for Online Consumers

Even if a consumer does retain their right to pursue legal recourse for a transaction problem, the legal system can be difficult to utilize. F2F processes of any kind are often infeasible for many consumers. Individuals lack the time, money, knowledge and patience to pursue even small claims court proceedings. People busy with work and family obligations are likely to give up in pursuing complaints when companies ignore their initial requests for assistance.

In addition, the courts are still very much tied to geography and jurisdiction. To decide how to resolve a legal case it first must be established which law applies. The same case can potentially get very different outcomes based on which law governs the resolution process. These days, however, which law applies is no longer a simple question to answer. A buyer in Brazil may purchase an item from a seller in France operating from a marketplace based in the United States, and the item may be shipped directly to the buyer from a warehouse in China. Which law would apply should a problem arise? And if the item is only worth $100, what lawyer would be willing to take the case to hammer out the complex jurisdictional questions? Which judge would have the power or aptitude to hear that case?

Even if a consumer does decide to file a case in court, why should the merchant care if the merchant is not subject to the jurisdiction of the court where the case is filed? If a consumer in Colorado buys an item from a merchant in Berlin and experiences a problem, why would the German merchant care if the consumer filed a complaint in a small claims court in Denver? And how is it reasonable to ask the consumer to retain counsel in Germany to file a case in the merchant’s home jurisdiction, if the value of the purchase is only a couple of hundred dollars and the cost of retaining a lawyer is several times that?

Consumer protection authorities face similar challenges. If a citizen reports a problem with a domestic seller, their local or national consumer protection agency has the authority to investigate the matter and potentially take enforcement action against the merchant. But if a citizen reports a problem with an international seller the consumer protection agency has no legal authority to pursue the matter. And as citizens increasingly engage in cross-border and international transactions, powered by the reach of new communication technologies, national and regional consumer protection authorities are continuing to lose ground in helping to protect their citizens from being taken advantage of. There are very few systems in place to enable regional and national consumer protection agencies and advocates to help consumers who have been victimized by merchants outside of their home geography. This problem will only get worse as e-commerce continues to expand. -

8 Crossing the Digital Divide

In the early 2000s, the biggest obstacle to expanding access to justice through technology was called the ‘digital divide’. The concern was that only rich people could afford technology and fast internet connections, so that technology-powered systems would disproportionally benefit the affluent. Many public investments in technology were put off due to this concern. Over the last 15 years, however, the dynamics have changed significantly. The introduction of inexpensive mobile phones have democratized access to the internet. There has been an increase in the number of individuals and households who have internet access, but concerns about the digital divide persist based primarily on educational attainment, age and household income. For example, the Pew Research Center (PRC) found in its 2013 study of broadband use that approximately 70% of adults had a high-speed broadband connection to the Internet, while 3% had a home dial-up connection. Home broadband use was greatest for white, non-Hispanic (74%) and lowest for Hispanic (53%) consumers.

However, the PRC also found that smartphone usage has created new means for accessing the Internet, especially for minority groups and those with lower economic means. For example, 10% of Americans do not have home broadband internet access, but they do own a smartphone. Smartphones also virtually eliminate the digital divide among races and ethnicities, with 80% of ‘White, Non-Hispanic’, 79% of ‘Black, Non-Hispanic’ and 75% ‘Hispanic’ having some internet access through home broadband or a smartphone. Still, smartphones widen the digital divide between 18 and 29 year olds and those over age 65 (increasing from a gap of 37 percentage points in home broadband access to 49 percentage points when taking smartphones into account).

There was a time when telephones were also considered to be luxuries, available only to the affluent. Over time, however, telephone access expanded to the point where public bodies were comfortable providing services via the telephone. It appears that internet access is at a similar tipping point. Policy makers and agencies now see the value of utilizing technology to deliver services more efficiently and effectively, and many now believe technology will help them get access to underprivileged populations. A phone manufacturer in India recently announced it was selling a smartphone for $7, and the government has begun giving out free tablets to school children. It appears that the price point for these technologies has fallen to a point where it is reasonable to presume near-ubiquity in terms of internet access, presuming all services are also optimized to be delivered through a mobile device in addition to a web- or computer-based experience. -

9 Credit Card Chargebacks

Some consumer advocates have argued that the best model currently available for protecting consumers is the credit card chargeback process. Under that process, consumers can contact their credit card issuer to reverse charges in transactions where the consumer was dissatisfied, even if the merchant disagrees. The chargeback system was originally put in place at the request of public consumer advocates and Attorneys General, and it does go a long way towards empowering consumers and creating a more level playing field.

However, the chargeback process is not essentially a resolution process. The chargeback system does not enable a conversation between the buyer and the seller to work out a transaction problem. The buyer participates in the process through their card issuer and the seller through their merchant services provider, making collaboration extremely difficult. If the buyer files a chargeback, the merchant is charged a fee and the payment is immediately reversed from the merchant’s account back to the consumer’s account. Merchants must often keep a deposit on file to fund these immediate reversals. If the merchant disagrees with the chargeback, they can ‘re-present’ the charge, and the money is reversed again. Each reversal involves an additional fee. Eventually, if the parties are determined enough, the case can be escalated to an arbitration administered by the card network. But the cost of that arbitration can be prohibitive, and only a tiny volume of cases ever get escalated to that level. Many merchants just give up when they receive a chargeback, because the chances of successful reversal are so low and the effort required so high.

As a result, the chargeback system is less a resolution process and more of a liability shift. The system is not designed to resolve disputes via mutual agreement. Most merchants hate the chargeback system, because they feel it gives too much power to the buyers, but because credit cards are so ubiquitous they have no choice but to accept credit card payments. Also, the credit card networks make money from the fees charged upon every reversal, and they also make money from the high interest rates charged to consumers who don’t pay off their full balance every month. It is somewhat ironic for consumer advocates to support a redress process funded largely by onerous interest payments carried by consumers who may have gotten underwater with the debt carried on their credit cards.

Chargebacks are also not a universal right. In Canada and North America the chargeback process is very generous, with consumers able to file chargebacks for all kinds of issues, including non-receipt and item quality disputes, but in other regions chargebacks are only allowed in cases of fraud or identity theft. Consumers are often unaware of their credit card chargeback rights, which means filing volumes are very low. Because of the cost associated with credit card payments, many merchants are trying to shift their payments onto debit or ACH networks, which have no chargeback rights other than fraud and unauthorized payment reversals. Some geographies rely heavily on bank transfers or stored value wallets, which also have inconsistent reversal rights. So while we can learn quite a bit from the chargeback system, it is not a realistically viable solution for consumer redress around the world. -

10 Envisioning a New Process

All of these challenges in trying to provide effective redress to consumers have created momentum behind an effort to change the way we think about consumer protection. The old zero-sum debate between consumer advocates (presumed to be in collaboration with the class action bar) and the big legal defence firms (presumed to be doing the bidding of big corporations) has achieved little in terms of progress over the past few decades. Each side has continued to point fingers, with businesses supposedly abusing customers and class action attorneys supposedly filing frivolous cases to force settlement. The debate over pre-dispute binding arbitration clauses is only the latest phase in this ongoing back and forth.

But the internet has continued to change the game even while the zero-sum debate was playing out in the courts and legislatures. In fact, while few were paying attention, some of the promising dynamics that had been identified by the internet futurists like Doc Searls in the 1990s have begun to pan out. Consumers are getting more skilled at using the internet to organize, and the wide spectrum of choice is moving towards more trustworthy merchants and marketplaces. While the regulators and lawyers were debating minimum standards and binding arbitration clauses, leading e-commerce businesses were going far beyond legal requirements for consumer protection. Forward-thinking merchants are creating the next generation systems that could handle consumer problems. Entirely new types of companies, sometimes called ‘sharing economy’ or ‘collaborative’ companies, were being started by consumers for others consumers. They were bringing a wholly new attitude to consumer protection.

Large internet intermediaries, like online marketplaces (eBay), large merchants (Amazon) and payment processors (Paypal), realized very early on that the consumer trust problem was creating friction on the internet and that solving it could provide a valuable market advantage. These companies weren’t willing to wait for regulators to figure out how to provide consumer protection on the internet, so they moved to build their own solutions to address the problem. For these large internet companies, trust in transactions proved to be a powerful competitive differentiator, one with a demonstrably positive impact on the bottom line.

Many forward-thinking consumer protection organizations began to recognize this trend as well. They saw that these new internet platforms were creating next-generation redress systems that were delivering fast and fair resolutions to consumers, all within the private sector. Instead of falling back into the old finger pointing between business and consumer advocates, there emerged a new zone of cooperation that offered some reason for optimism. The 2003 agreement between Consumers International and the Global Business Dialogue on e-commerce (GBDe) was an important step in this direction. Suddenly two groups that had long been tugging on either end of the rope and getting nowhere were finding ways they could now both pull on the same side, working together in common purpose.

Regulators as well had come to the conclusion that court-based approaches to consumer protection were destined to fail in an internet-powered economy. Long-standing efforts to resolve jurisdictional questions around consumer disputes, like the Hague Conference on Private International Law, were not getting any closer to agreement despite decades of negotiation. A proposition to legally locate all consumer disputes in the home jurisdiction of the consumer was presented by the Canadian and Brazilian delegations to the Organization of American States (OAS) in 2009, but the concept was met with quite a bit of resistance. How could internet merchants defend themselves in every jurisdiction around the world? The concept seemed out of step with where the economy was going.

In response to the Brazilian and Canadian proposal, the US State Department offered a blueprint for the use of ODR to build a global, cross-border system for resolving consumer disputes. The proposal was met with such enthusiasm that UNCITRAL decided to devote a Working Group to the concept, Working Group III, which has met bi-annually in Vienna and New York for the last 6 years to flesh it out in more detail. Similarly, the European Parliament passed a regulation requiring all member states to implement cross-border consumer ODR by the middle of 2016. The European Standards organization, the International Standards Organization and the Canadian legislature all quietly issued standards for quality ODR. It was clear that a consensus was building up.

In fact, the OECD’s Committee on Consumer Policy recently released a draft recommendation from the Council of Consumer Protection in eCommerce that reads, in part:Consumers should have access to ADR mechanisms, including online dispute resolution systems, to facilitate the resolution of claims over e-commerce transactions, with special attention to low value or cross-border transactions. Although such mechanisms may be financially supported in a variety of ways, they should be designed to provide dispute resolution on an objective, impartial, and consistent basis, with individual outcomes independent of influence by those providing financial or other support. (Art. 45)

The OECD document goes on to state that “The development by businesses of internal complaints handling mechanisms, which enable consumers to informally resolve their complaints directly with businesses, at the earliest possible stage, without charge, should be encouraged.” For an organization focused on consumer protection to be specifically calling on merchants to build their own private resolution processes is a big breakthrough, and an indicator of how universal these sentiments have become.

The Civil Justice Council in the United Kingdom recently conducted an extended study of ODR in civil cases, eventually recommending that the Ministry of Justice create something called ‘Her Majesty’s Online Court’, which could resolve all cases under £25,000 through ODR mechanisms. As the Master of the Rolls said in the Forward to the final report, “ODR will play an important role in the future of civil justice.” Similar conclusions are being reached by judicial luminaries around the world. After much study and inquiry, they are concluding that we cannot update our old legal redress systems fast enough to keep up with the changes being wrought by the internet. We need to build for the future. Software-enabled private resolution processes, backed by private enforcement, are seen by many judges and regulators as a much better fit with the needs of online consumers than legal redress options. -

11 Call For Action

UNCITRAL’s ODR Working Group has now wrapped up. Although its participants have not been able to craft a final set of procedural rules for ODR that all the member delegations could ratify, there was an overwhelming sense that actors from around the globe seek to ultimately create an ODR process for consumers worldwide. Indeed, the EU has launched their own ODR platform in the first half of 2016 alongside a regulation that requires all online merchants in the EU to inform their customers of the availability of ODR. The EU ODR platform also provides a link to the ODR filing form, which is being set up by the EU itself. However, the EU system only governs consumers and merchants within the EU, so consumers outside of the EU do not have an equivalent system should they encounter a problem. These actions, and the emerging consensus behind them, are opening a window of opportunity. Now is the time to build the next generation of consumer protection, undergirded by the tools of ODR.

Literature A. Ayal, ‘Harmful Freedom of Choice: Lessons from the Cellphone Market’, Law & Contemp. Probs., Vol. 74, 2011, pp. 91-100.

L. Babcock & S. Laschever, Women Don’t Ask: Negotiation and the Gender Divide, Princeton University Press, 2003, p. 20.

O. Bar-Gill & E. Warren, ‘Making Credit Safer’, U. Pa. L. Rev., Vol. 157, No. 1, 2008, p. 22.

O. Bar-Gill & R. Stone, ‘Mobile Misperceptions’, Harv. J.L. & Tech., Vol. 23, 2009, p. 118.

L. Bates, ‘Administrative Regulation of Terms in Form Contracts: A Comparative Analysis of Consumer Protection’, Emory Int’l l. Rev., Vol. 16, 2002, pp. 29-33.

S.I. Becher, ‘Behavioral Science and Consumer Standard Form Contracts’, La. L. Rev., Vol. 68, 2007, pp. 122-124.

L. Beckett, ‘Everything We Know About What Data Brokers Know About You’, Pro-Publica, 7 March 2013, available at: <www.propublica.org/article/everything-weknow-about-what-data-brokers-know-about-you> (last accessed 19 August 2013).

O. Ben-Shahar & C.E. Schneider, ‘The Failure of Mandated Disclosure’, Chi. Law Sch. John M. Olin Law & Econ. Working Paper, 2d Series, Paper No. 516, 2010, pp. 7-20, 40-55, available at: <www.law.uchicago.edu/files/file/516-obs-disclosure.pdf>.

M. Brownell, ‘Credit Card Chargebacks: Your Secret Weapon in Merchant Disputes’, Daily Finance, 31 July 2012, available at: <www.dailyfinance.com/2012/07/31/credit-card-chargeback-merchant-disputes>.

D.W. Carbado & M. Gulati, ‘Conversations at Work’, Or. L. Rev., Vol. 79, 2000, pp. 108-110.

Consumer Financial Protection Agency Act, H.R. 3126, 111th Cong. §§ 111(a), 134(a) (2009).

Consumer Financial Protection Bureau, ‘About us’, <www.consumerfinance.gov/the-bureau> (last accessed 1 January 2014).

Consumer Financial Protection Bureau, ‘CFPB and DOJ Order Ally to Pay $80 Million to Consumers Harmed by Discriminatory Auto Loan Pricing’, 20 December 2013, available at: <www.consumerfinance.gov/newsroom/cfpb-and-doj-order-ally-to-pay-80-million-to-consumers-harmed-by-discriminatory-auto-loan-pricing> (noting that the Equal Credit Opportunity Act prohibits “creditors from discriminating against loan applicants in credit transactions on the basis of characteristics such as race and national origin”).

C.B. Craver & D.W. Barnes, ‘Gender, Risk Taking, and Negotiation Performance’, Mich. J. Gender & L., Vol. 5, 1999, pp. 309-310.

Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, 124 Stat. 1376 (2010) (codified in scattered sections of the U.S. Code).

Federal Communications Commission (FCC), ‘FCC Proposes $5.2 Million Fine Against U.S. Telecom Long Distance, Inc. for Deceptive Slamming, Cramming, and Billing Practices’, 24 January 2014, available at: <www.fcc.gov/document/fcc-proposes-52-m-fine-against-us-telecom-long-distance-inc>.

E.J. Kelley, Jr. et al., ‘Offers of Judgment in Class Action Cases: Do Defendants Have a Secret Weapon?’, Consumer Fin. L. Q. Rep., Vol. 54, 2000, p. 283.

R. Korobkin, ‘Bounded Rationality, Standard Form Contracts, and Unconscionability’, U. Chi. L. Rev., Vol. 70, 2003, pp. 1204-1206, 1222-1225, 1243-1244.

R. Korobkin, ‘Symposium, Inertia and Preference in Contract Negotiation: The Psychological Power of Default Rules and Form Terms’, Vand. L. Rev., Vol. 51, 1998, pp. 1605-1609, 1627.

D.H. Koysza, ‘Preventing Defendants from Mooting Class Actions by Picking Off Named Plaintiffs’, Duke L.J., Vol. 53, 2003, p. 789.

M.B.M. Loos, ‘Individual Private Enforcement of Consumer Rights in Civil Courts in Europe’, Ctr. for the Study of Eur. Contract Law Working Paper Series, Paper No. 2010/01, pp. 5-14, available at: <http://ssrn.com/abstract=1535819>.

J.B. Merrill, ‘One-Third of Top Websites Restrict Customers’ Right to Sue’, N.Y. Times, 23 October 2014), available at: <www.nytimes.com/2014/10/23/upshot/one-thirdof-top-websites-restrict-customers-right-to-sue.html> (last accessed 24 November 2014).

G.S. Moohr, ‘Opting In or Opting Out: The New Legal Process or Arbitration’, Wash. U. L.Q., Vol. 77, 1999, pp. 1093-1097.

R.A. Posner, ‘Rational Choice, Behavioral Economics, and the Law’, Stan. L. Rev., Vol. 50, 1998, pp. 1559-1575.

R.A. Posner, Economic Analysis of Law, 7th ed., Aspen Publishers, 2007, pp. 3-28.

W.H. Redmond, ‘Consumer Rationality and Consumer Sovereignty’, Rev. Soc. Econ., Vol. 58, 2000, p. 177.

W.J. Rinke, Don’t Oil the Squeaky Wheel: And 19 Other Contrarian Ways to Improve Your Leadership Effectiveness, McGraw-Hill Education, 2004, pp. 133-138.

L.A. Rudman, ‘Self-Promotion as a Risk Factor for Women: The Costs and Benefits of Counterstereotypical Impression Management’, J. of Personality & Soc. Psychol., Vol. 74, 1998, pp. 629-630.

P.B. Rutledge & A.W. Howard, ‘Arbitrating Disputes Between Companies and Individuals: Lessons from Abroad’, Disp. Resol. J., Vol. 65, 2010, p. 33.

F.E.A. Sander & L. Rozdeiczer, ‘Matching Cases and Dispute Resolution Procedures: Detailed Analysis Leading to a Mediation-Centered Approach’, Harv. Negot. L. Rev., Vol. 11, 2006, p. 14.

A.J. Schmitz, ‘Access to Consumer Remedies in the Squeaky Wheel System’, Pepp. L. Rev., Vol. 39, No. 2, 2012, p. 313 (quoting A. Best & A.R. Andreasen, ‘Consumer Response to Unsatisfactory Purchases: A Survey of Perceiving Defects, Voicing Complaints, and Obtaining Redress’, Law & Soc’y Rev., Vol. 11, 1977, p. 723).

J.I. Shinder, ‘In Praise of Class Actions’, Nat’l L.J., 5 April 2010, p. 39.

D.P. Stark & J.M. Choplin, ‘A Cognitive and Social Psychological Analysis of Disclosure Laws and Call for Mortgage Counseling to Prevent Predatory Lending’, Psychol. Pub. Pol’y & L., Vol. 16, 2010, pp. 98-99.

A.F. Stuhlmacher & A.E. Walters, ‘Gender Differences in Negotiation Outcome: A Meta-Analysis’, Personnel Psychol., Vol. 52, 1999, p. 656.

A.F. Stuhlmacher et al., ‘Gender Difference in Virtual Negotiation: Theory and Research’, Sex Roles, Vol. 57, 2007, pp. 334-336.

B. Tronvoll, ‘Complainer Characteristics When Exit Is Closed’, Int’l J. Serv. Industry Mgmt., Vol. 18, 2007, pp. 25-51, available at <www.emeraldinsight.com/0956-4233.htm>.

U.S. Gov’t Accountability Office, Gao-10-518, ‘Factors Affecting the Financial Literacy of Individuals with Limited English Proficiency’, 2010, pp. 9-10, available at: <www.gao.gov/new.items/d10518.pdf>.

At the dawn of the internet age many futurists predicted that technology would shift the balance of power between consumers and merchants in favour of consumers. In his seminal book The Cluetrain Manifesto (written in 1999 with Rick Levine, David Weinberger and Christopher Locke), Doc Searls predicted that technology would usher in a golden age of consumer choice, where buyers would use the wide range of options provided to them by frictionless e-commerce to play merchants off of each other, ensuring that consumers got the best deals and the widest selection in every online exchange.

But that vision is still a work in progress. In some respects the internet has achieved the opposite, ushering in a new age of consumer confusion and disempowerment. Consumers do have access to more information than they did in the past, but many buyers still have a hard time making sense of it to figure out which merchants are the most trustworthy. It is also still too hard for consumers to learn how to resolve transaction problems when they arise. Some merchants and marketplaces have leveraged the wide-open, wild-west nature of the internet to sow even more fear, uncertainty and doubt among consumers, further preventing them from holding bad merchants accountable. A new breed of fraudster has emerged as well, savvy in the ways of the internet and skilled at covering their online tracks. In retrospect, the new reach and choice provided by the internet have unquestionably expanded purchasing options for consumers, but utopian predictions about a golden age of consumer empowerment remain unrealized.

Almost every industry has been reinvented by the expansion of information and communications technology, from medicine to finance to entertainment. But the redress processes made available to most consumers have not evolved in a similar way. Most resolution options available to consumers resemble those available decades ago: a 1-800 number, a complaint form, or an unsatisfying online chat process. For most consumers in the modern era, none of those options sounds very appealing. At the same time, small claims court is often unavailable or unsatisfactory for many claims due to jurisdictional limits, long time frames and other complexities.